What to Expect From a Life Insurance Policy Quote sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

This guide will delve into the various aspects of life insurance policies, shedding light on what factors influence quotes, coverage options available, and the quoting process itself.

Types of Life Insurance Policies

When considering a life insurance policy quote, it's important to understand the different types of policies available to choose from. The main types of life insurance policies are term life insurance, whole life insurance, and universal life insurance. Each type has its own unique features and benefits, catering to different needs and preferences.

Term Life Insurance

Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. Term life insurance is typically more affordable than other types of life insurance and is a good option for those looking for temporary coverage.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured, as long as the premiums are paid. It offers a death benefit to the beneficiaries and also includes a cash value component that grows over time. Whole life insurance premiums are usually higher than term life insurance but offer lifelong protection and a savings component.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that allows policyholders to adjust their premiums and death benefits. It also includes a cash value component that earns interest over time. Universal life insurance offers more flexibility and customization compared to whole life insurance, making it a popular choice for those looking for a personalized policy.It's important to carefully consider your financial goals and needs when choosing a life insurance policy.

Each type of policy has its own advantages and disadvantages, so it's essential to compare and contrast the features of term life insurance, whole life insurance, and universal life insurance to determine which option best suits your individual circumstances.

Factors Affecting Life Insurance Quotes

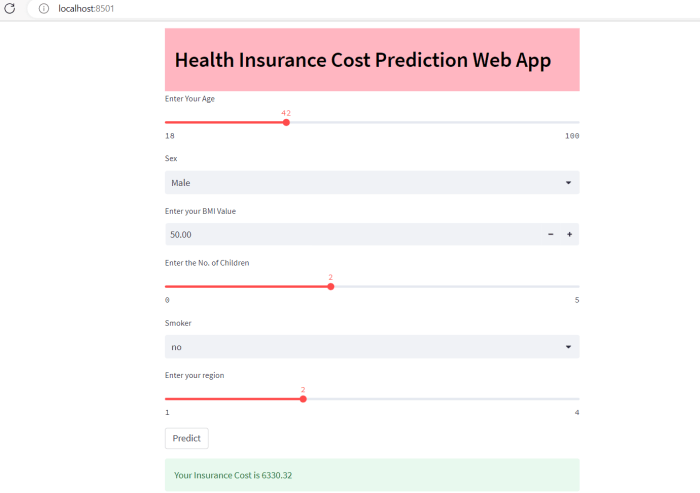

When it comes to determining the cost of a life insurance policy quote, several key factors come into play. These factors can significantly impact the final premium amount and the overall affordability of the policy. Understanding these factors is crucial for individuals seeking the right life insurance coverage.Age, health, lifestyle, occupation, and coverage amount are among the primary factors that influence life insurance quotes.

Insurers assess these factors to determine the level of risk associated with insuring an individual and adjust the premium accordingly.

Age

Age is a critical factor in determining life insurance quotes. Typically, younger individuals are quoted lower premiums as they are considered lower risk compared to older individuals. Insurers take into account life expectancy and the likelihood of health issues at different ages when calculating premiums.

Health

Health plays a significant role in life insurance quotes. Individuals in good health are likely to receive lower premiums compared to those with pre-existing medical conditions or poor health. Insurers may require medical examinations or access to medical records to assess an individual's health status accurately.

Lifestyle

Lifestyle choices such as smoking, excessive alcohol consumption, or engaging in high-risk activities can impact life insurance quotes. Insurers consider these factors when assessing the overall risk profile of an individual. Adopting healthier lifestyle habits can lead to more affordable premiums.

Occupation

Certain occupations are considered riskier than others, which can affect life insurance quotes. Individuals working in hazardous or high-risk professions may face higher premiums due to the increased likelihood of workplace-related injuries or accidents. Insurers take into account the occupational risk when pricing policies.

Coverage Amount

The coverage amount selected by an individual also plays a crucial role in determining life insurance quotes. Higher coverage amounts typically result in higher premiums. Individuals should carefully consider their financial obligations and long-term needs when choosing the coverage amount to ensure adequate protection.

Underwriting Criteria

Underwriting criteria, which include factors such as family medical history, genetic predispositions, and lifestyle assessments, are used by insurers to evaluate the risk profile of an individual

Coverage Options and Riders

When considering a life insurance policy, it's essential to understand the coverage options and riders that can be added to customize your policy to meet specific needs.

Common Riders

- Accidental Death Benefit: This rider provides an additional payout if the insured's death is the result of an accident, on top of the base policy coverage.

- Disability Income Rider: With this rider, the policyholder can receive a regular income if they become disabled and are unable to work.

- Waiver of Premium: This rider waives future premium payments if the insured becomes disabled and unable to work, ensuring the policy remains active.

Customizing Your Policy

Adding riders to your life insurance policy allows you to tailor the coverage to your specific circumstances. For example, if you have a high-risk job, you may want to add the accidental death benefit rider for added protection. Or if you're concerned about losing your income due to a disability, the disability income rider can provide peace of mind.Consider your individual needs and risks when choosing which riders to add to your policy.

Each rider comes with an additional cost, so it's important to weigh the benefits against the added premiums to ensure you have the right coverage in place.

The Quoting Process

When it comes to obtaining a life insurance policy quote, there are specific steps involved in the process. From requesting quotes to comparing the options available, understanding the quoting process is essential to finding the most suitable policy for your needs.

Requesting Quotes

- Contact Insurance Companies: Reach out to different insurance companies directly to request quotes for life insurance policies. You can do this by visiting their websites, calling their customer service lines, or reaching out to local agents.

- Work with Agents: Another option is to work with independent insurance agents who can provide you with quotes from multiple companies, helping you compare different policy options.

- Provide Necessary Information: When requesting quotes, be prepared to provide information about your age, health condition, lifestyle, and coverage needs. This information will help insurers determine the cost of your policy.

Comparing Quotes

- Review Coverage Options: Look closely at the coverage offered by each policy quoted to ensure it meets your needs and provides adequate protection for your loved ones.

- Consider Premium Costs: Compare the premium costs associated with each quote, taking into account your budget and financial capabilities to ensure you can afford the policy in the long run.

- Understand Policy Features: Pay attention to any additional features or riders included in the policy quotes, such as accelerated death benefits or waiver of premium, to determine their value to you.

- Seek Professional Advice: If you find the quoting process overwhelming, consider seeking advice from a financial advisor or insurance expert who can help you navigate the options and make an informed decision.

Summary

In conclusion, understanding what to expect from a life insurance policy quote is crucial in making an informed decision about your financial future. By considering the types of policies, factors affecting quotes, coverage options, and the quoting process, you are better equipped to navigate the world of life insurance with confidence.

FAQ Corner

What factors can influence the cost of a life insurance policy quote?

Age, health, lifestyle choices, occupation, and coverage amount are key factors that can impact the cost of a life insurance policy quote.

What are some common riders that can be added to a life insurance policy?

Common riders include accidental death benefit, disability income rider, and waiver of premium. These riders can provide additional coverage tailored to specific needs.

How can I compare quotes to find the most suitable policy?

To compare quotes effectively, review the coverage options, premiums, and any additional riders offered by different insurance companies. Consider your specific needs and financial situation to find the policy that best fits your requirements.