Beginning with Comparing Life Assurance and Life Insurance: Know the Difference, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

When it comes to financial planning, understanding the distinctions between life assurance and life insurance is crucial. Let's delve into the nuances of these two terms and unravel the complexities behind them.

Understanding Life Assurance and Life Insurance

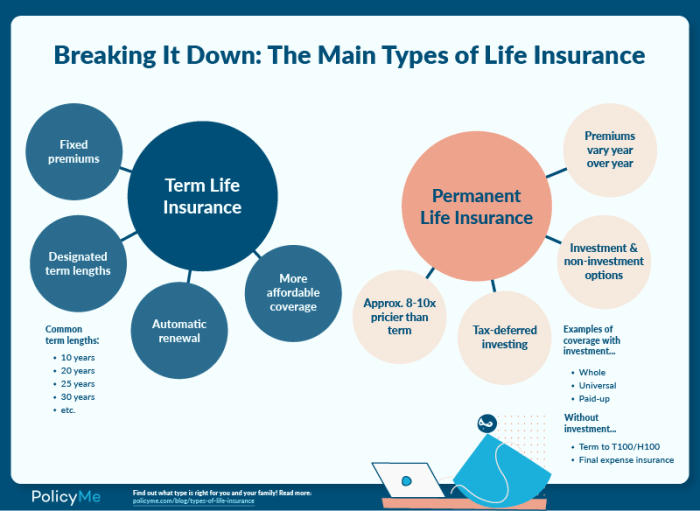

Life assurance and life insurance are both financial products designed to provide financial protection to beneficiaries in the event of the policyholder's death. However, there are key differences between the two that are important to understand.Life assurance is a type of insurance that covers the policyholder for their entire life, with a guaranteed payout to beneficiaries upon the policyholder's death.

Premiums for life assurance policies tend to be higher because they provide coverage for a longer period of time.On the other hand, life insurance provides coverage for a specific term, such as 10, 20, or 30 years. If the policyholder dies within the term of the policy, a payout is made to the beneficiaries.

If the policyholder outlives the term, there is no payout.

Situations where Life Assurance is more suitable than Life Insurance

- For individuals who want coverage for their entire life rather than a specific term, life assurance is more suitable.

- People who want to ensure that their beneficiaries receive a guaranteed payout regardless of when they pass away may opt for life assurance.

- Those who are looking for an investment component along with their insurance coverage may find life assurance more appealing, as it often includes a savings or investment element.

Coverage and Benefits

Life assurance provides coverage for the entire lifespan of the policyholder, ensuring that a payout is made regardless of when the insured individual passes away. This guarantees financial security for beneficiaries in the event of the policyholder's death.On the other hand, life insurance offers financial protection for a specific term or period, typically ranging from 10 to 30 years.

If the insured individual passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

Coverage Provided by Life Assurance

Life assurance offers a lifetime coverage, meaning that the policyholder is covered until they pass away, regardless of when it happens. This provides a sense of security and peace of mind to both the policyholder and their beneficiaries.

Benefits of Life Insurance in Terms of Financial Protection

Life insurance provides a lump sum payout, known as the death benefit, to the beneficiaries if the insured individual passes away during the term of the policy. This ensures that loved ones are financially protected and can maintain their standard of living in case of the policyholder's untimely death.

Comparison of Coverage and Benefits

When comparing life assurance and life insurance, it's essential to consider the coverage and benefits each option offers. Life assurance provides lifelong coverage, ensuring a payout whenever the policyholder passes away. On the other hand, life insurance offers financial protection for a specified term, with a death benefit paid out if the insured individual dies during the policy term.

Both options serve to provide financial security to beneficiaries, but the duration and terms of coverage differ between life assurance and life insurance.

Premiums and Payouts

When it comes to life assurance and life insurance, understanding how premiums are calculated and the payout structure is crucial for making informed decisions about your coverage.

Premiums for Life Assurance

Premiums for life assurance are typically calculated based on various factors such as age, health status, lifestyle habits, and the amount of coverage you choose. Insurers may also take into account your occupation and family medical history when determining your premium.

The goal is to assess the level of risk you pose as a policyholder.

Payout Structure for Life Insurance Policies

Life insurance policies usually offer a lump-sum payout to the beneficiaries upon the policyholder's death. The amount of the payout is predetermined when the policy is purchased and is usually tax-free for the beneficiaries. Some policies may also include additional benefits such as coverage for critical illness or disability.

Differences in Premium Costs and Payouts

- Life assurance premiums tend to be higher compared to life insurance due to the broader coverage and long-term nature of the policy.

- Life insurance policies generally offer a fixed payout amount, while life assurance policies may provide a payout based on the performance of the underlying investment.

- Life assurance policies can offer a savings or investment component, allowing policyholders to accumulate cash value over time, which may affect the payout amount.

Policy Flexibility and Terms

Life assurance policies often offer more flexibility compared to life insurance policies. Life assurance policies typically provide the policyholder with the option to adjust the coverage amount, change beneficiaries, or even take a loan against the policy's cash value. On the other hand, life insurance policies usually have more rigid terms and conditions.

Flexibility of Life Assurance Policies

Life assurance policies usually allow the policyholder to make changes to the coverage amount, beneficiaries, and even access the cash value through policy loans. This flexibility can be beneficial for individuals who may require adjustments to their coverage over time.

- Policyholders can adjust the coverage amount based on their changing financial needs.

- Beneficiaries can be easily changed if the policyholder's circumstances or relationships evolve.

- Policy loans can be taken against the cash value of the policy, providing financial flexibility in times of need.

Terms of Life Insurance Policies

Life insurance policies typically come with more stringent terms and conditions compared to life assurance policies. These policies often have fixed coverage amounts, limited options for changing beneficiaries, and do not usually offer the ability to access cash value through policy loans.

- Coverage amounts are usually fixed and may not be adjusted without purchasing a new policy.

- Changing beneficiaries may require additional paperwork and approval from the insurance company.

- Policy loans are not typically available with life insurance policies, limiting financial flexibility.

Comparison of Policy Flexibility and Terms

When comparing life assurance and life insurance policies, it is evident that life assurance policies offer more flexibility in terms of adjusting coverage, changing beneficiaries, and accessing cash value through policy loans. On the other hand, life insurance policies have more rigid terms and conditions, with limited options for policy adjustments.

Individuals seeking more control and flexibility over their policy may find life assurance policies to be a better fit for their needs.

Final Wrap-Up

In conclusion, the comparison between life assurance and life insurance sheds light on the importance of making informed decisions when it comes to securing your financial future. By knowing the differences and benefits of each, you can tailor your coverage to best suit your needs and protect your loved ones effectively.

FAQ Compilation

What is the main difference between life assurance and life insurance?

Life assurance typically covers the policyholder for their entire life, while life insurance provides coverage for a specified term.

How are premiums calculated for life assurance?

Premiums for life assurance are usually calculated based on the individual's age, health, and coverage amount.

What are the key benefits of life insurance in terms of financial protection?

Life insurance offers a lump-sum payout to beneficiaries upon the policyholder's death, providing financial security and support.